I know I haven’t posted anything for a while now. I have something long and thorough prepared, but I’m not yet entirely satisfied and need to tie up a few loose ends.

In the meantime, I’ll try to warm up by posting a short note on a matter that was not quite clear to me and may be beneficial to readers: some quirks of the so-called MAR, or market abuse regulation.

Oh, a regulation you say? Boooooring. But hear me out, it’s not that bad (and actually a bit funny).

The market abuse regulation or, in its full glory “Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse”, or in short “MAR” was enacted 10 years ago to provide a basic framework within the EU for the legal provisions relating to, mainly, “insider trading” i.e. which market transactions on material non-public information or by people that are deemed “in the know” is allowed or forbidden, and the required disclosures.

While it is certainly a regulatory burden for the concerned parties (individuals and companies that have to be careful what/when they trade, and to disclose it), the required disclosue is a rare possibility for enterprising market participants to see (with a few days of delay) how executives, directors or “related” large shareholders are transacting in the shares of the companies they influence or know a great deal about.

The disclosures are regularly published, either by the concerned companies or on a central website of the market regulator, depending on the member state. The disclosures contain the date and venue of the transaction (on or off-market), the type of transaction (buy, sell, donation/gift, lending, …) and the person or entity that made the transaction. One very important point is that large shareholders do not need to disclose their transactions. But (there’s always a but), often there is a direct link between an executive or director and a large shareholder (or the person is itself a large shareholder), and then these disclosures can be very helpful.

We will look at the details and what we can learn from one recent example that prompted me to investigate one special rule which I think (this is not legal advice, I am not a lawyer and this may turn out to be very wrong!) applies here: the split of Vivendi SE.

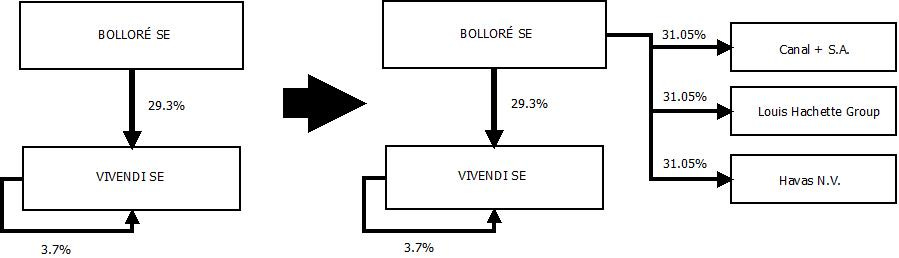

I think most will know what happened with this split, but I’ll summarise it briefly: the french media conglomerate Vivendi had one main shareholder, Bolloré SE, controlled by the Bolloré family (and itself, but that is maybe for another time). Bolloré SE owns just below 30% of the shares (together with other related parties, the shareholding is just a few shares shy of the magical 30% threshold which would require a mandatory offer to all other shareholders). Bolloré has been very careful to not (yet?) cross that threshold - but there was another clever way to increase its control. Vivendi bought back a good deal of its own shares (it bought back a little less than 4% over the summer of 2024), and then distributed shares of three fully-owned subsidiaries (Havas, Louis Hachette and Canal+) to its shareholders. Since the shares owned by Vivendi (3.7%) don’t participate in the distribution, Bolloré would become a new shareholder with a holding of more than 30% in these entities and thus not be required to make a mandatory offer (see picture below). Very nice!

Now the reason(s) why you would want to do that could be that

- now Vivendi is a “lighter” target to make a bid for,

- or it could also be that you’d like to increase your holding in the new entities at your leisure, without fearing the requirement to make a mandatory offer

- (and, by extension it could also mean that all that remains in the entity in which you don’t yet hold >30% is not something you want to currently increase your holding in)

The question now is: can we know if Bolloré is buying up shares in Canal+, Louis Hachette or Havas? Let’s look at disclosures and what the MAR tells us.

Of course, this wouldn’t be a Bolloré transaction if it weren’t coming with a few special twists. All three entities were listed on different markets: Havas on Euronext Amsterdam (the Netherlands), Louis Hachette on Euronext Growth in Paris (France), and Canal+ on the London Stock Exchange (UK, but remaining a french company).

HAVAS

Let’s first look at Havas. Director’s transactions (MAR) and threshold crossings are reported to the AFM (Autoriteit Financiële Markten, dutch financial markets authority).

Since the listing, there were a number of disclosures of “director’s dealings: https://www.afm.nl/en/sector/registers/meldingenregisters/bestuurders-commissarissen?KeyWords=havas

as well as disclosures according to Article 19 MAR:

https://www.afm.nl/en/sector/registers/meldingenregisters/transacties-leidinggevenden-mar19-?KeyWords=havas

(screenshot for posterity)

In the director’s dealings, some members of the board and management declared purchases, and also the receipt of shares from the split of Vivendi (they held Vivendi shares before the split and thus received Havas shares).

The article 19 MAR disclosures only list transactions in the shares, and here we notice a first interesting pattern: Yannick Bolloré, the executive director, chairman and CEO of Havas, has been buying quite a lot of shares. The shares are now owned by a private company that he fully owns and controls called “YB6”, incorporated in France.

From a quite low initial amount (Yannick Bolloré held 134 016 shares of Vivendi, and thus received 134 016 shares of Havas in the split), he bought some 28 million additional shares over the past month, paying 49 million Euros for a stake of 2.85% in the company that he is now leading as chairman and CEO. Adding some restricted shares on top as part of his remuneration, his stake now already exceeds 3%, which was duly notified as he crossed the 3% threshold at the beginning of 2025.

Has Bolloré SE been buying as well? My answer would be “(probably) not”, because Yannick Bolloré, YB6, Compagnie de l’Odet (the family holding) and Bolloré SE entered into a “relationship agreement” meaning they would act in concert regarding Havas. Some details were given in the listing information document in section 13.2:

The acting in concert does, however, mainly apply to the question of ownership thresholds, and the intention was to avoid having to make a mandatory bid for the company. This would only make sense if one of the parties were to reduce their stake, since the combined stake of the concert was already above 30% from the start. So one possibility/option here is that Bolloré/Odet could reduce their stake (temporarily or not) below 30% while the concert YB6-Bolloré-Odet remains above 30% - so e.g. Bolloré could not be forced into a mandatory offer if it decided to increase its stake again (or YB6 would not have to make an offer if it came to own more than 30% at some point in the future…).

The fact that such agreements were not entered into at the other entites does at least suggest that the focus of Bolloré SE is not to increase its stake at the moment (or it is to allow Yannick Bolloré to up his personal stake via YB6 above 30% at some point in the future without the requirement of a mandatory bid - you could call it careful succession planning). [In case you don’t know: Yannick Bolloré is one of the children of Vincent Bolloré, the controlling shareholder of the Bolloré group]

Canal+ and Louis Hachette

In terms of disclosures, there was far less activity at these entities than at Havas. Some directors and executives bought a few shares, but nothing material that would change the shareholder structure. One interesting thing happened at Louis Hachette, though: Arnaud Lagardère exercised most of his transfer rights on the Lagardère shares he held and thus sold them to Vivendi SE for a price of 24.1€. The market price at that time was around 20€, and Louis Hachette (whose main asset is a 66.5% stake in Lagardère) was (and still is) trading at a significant discount to the market value of its Lagardère stake. So Arnaud Lagardère took the money from Vivendi and bought Louis Hachette Group shares on the open market in large amounts. In a leaked e-mail to Lagardère employees he wrote that his stake in Louis Hachette “now already exceeded his former stake in Lagardère” - which was above 5%. But the new stake of Arnaud Lagardère was never notified officially, because Louis Hachette Group is listed on Euronext Growth - where only the thresholds of 50% and 90% give rise to a declaration obligation.

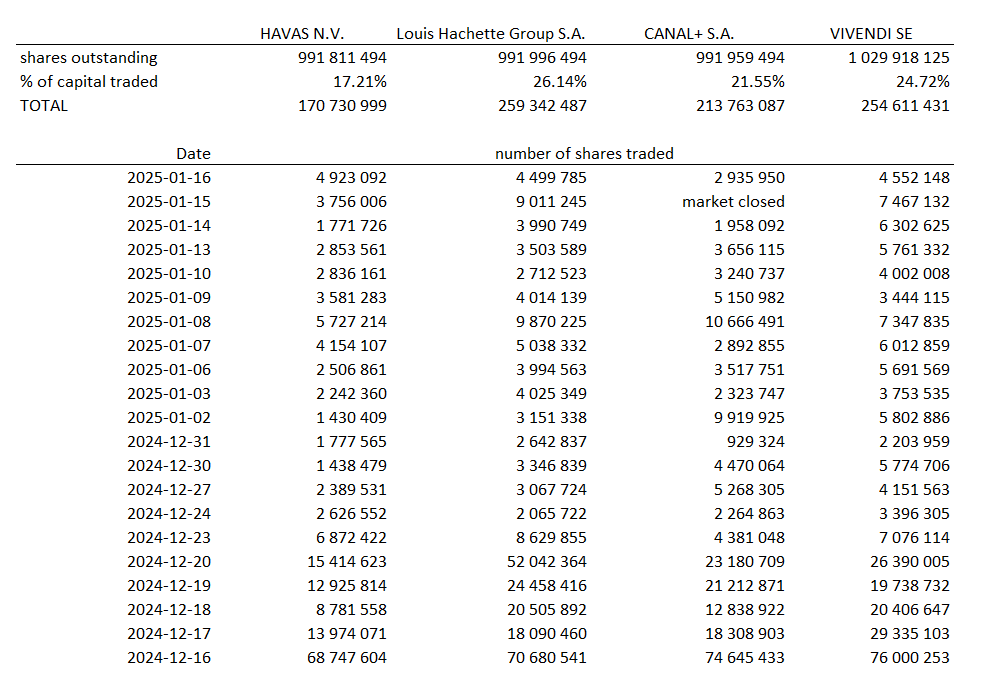

It is, however, interesting to note that the trading volume in Louis Hachette has been significantly higher than in the other entities. We now have one full month of trading history since the split (of course, the holidays are included, but still):

in total, more than 26% of Louis Hachette Group shares have changed hands since the listing, which is quite a lot if you assume that the main shareholder (Bolloré) has not been day-trading its stake hyperactively. If we take out the “Arnaud Lagardère effect”, we end up with a number quite similar to the Canal+ amount, around 20%. If we remove the ~3% of Havas bought by Yannick Bolloré, the Havas trading volume is surprisingly low (relatively speaking) while Vivendi was really active without any Bolloré involvement (assuming they did not, in fact, sell shares!)

But the real question remains - is there any clue that “they” (Bolloré group) have been buying in Havas, Canal+ or Louis Hachette?

Have they been buying?

Let’s review the facts:

no crossing of thresholds were disclosed by Bolloré SE or related entities (only the additional 3% individually held by Yannick Bolloré at Havas)

there were no Article 19 MAR transactions reported by Bolloré SE or related entities

So the question is: would Bolloré SE be required to disclose trading in shares under article 19 of the MAR?

Let’s look into it:

Article 19 states that notifications have to be made by “persons discharging managerial responsibilities” (PDMR), as well as “persons closely associated with them”. What does that mean? As in any well-crafted european regulation, this is defined in detail in article 3(1) “definitions”:

The main relevant part here is (26)(d): “a legal person (…) the managerial responsibilities of which are discharged by a PDMR (…), which is directly of indirectly controlled by such a person (…) or the economic interests of which are substantially equivalent to those of such a person”

Let’s first look at which PDMR might lead to Bolloré SE being declared a “person closely associated”, and thus requiring its trades to be made public. It is only Yannick Bolloré.

Yannick Bolloré is vice-chairman of the board of Bolloré SE.

He is also

a director of Louis Hachette Group

chairman of the supervisory board of Canal+

chairman of the supervisory board of Vivendi

executive director, chairman and CEO of Havas

if you take the MAR literally, Bolloré SE is a “person closely associated”, since Y. Bolloré is, according to the definition, a PDMR at Bolloré SE and also a PDMR at Louis Hachette, Canal+, Vivendi and Havas.

So Bolloré SE did not transact in any shares, since nothing was declared!

Not so fast - because (I kid you not, I hope you appreciate the irony of this) “a literal interpretation (…) would lead to a disproportionate extension of the reporting obligation” 🤣(literal quote from the website of BaFin, the german market regulator)

the EU agency in charge of implementing this whole masterpiece, the European Securities and Markets Authority (ESMA) has “clarified” (LOL) that the same term “discharge of managerial responsibilities” means something very different when it is written in Article 3(1)(25), than when it is written in Article 3(1)(26)(d), just a few lines below. 😵💫

The relevant intellectual gymnastics are detailed in ESMA’s Q&A relating to the MAR: (please read this carefully)

I hope you thoroughly appreciate the beauty and craftsmanship of european regulations! Just like Champagne, it can only legally be called an EU regulation if it is clarified in all its nuances and subtle meanings by an official EU agency.

So what does that mean?

My interpretation: Yannick Bolloré has (on paper) “mere cross board membership” with Bolloré SE. He is not the CEO of Bolloré SE (his brother Cyrille is…) and thus is not “taking part of influencing the decisions” of Bolloré SE to transact in shares of Vivendi, Havas, Canal+ or Louis Hachette. Therefore, the PDMR Yannick Bolloré at Vivendi, Havas, Canal+ and Louis Hachette is not a PDMR at Bolloré SE and therefore, Bolloré does not have to notify transactions according to article 19 of the MAR.

Nice - that is our complete layman’s interpretation of a crucial legal matter. Is there any way to check whether this holds?

As it turns out, there is a way.

Check 1 - UMG

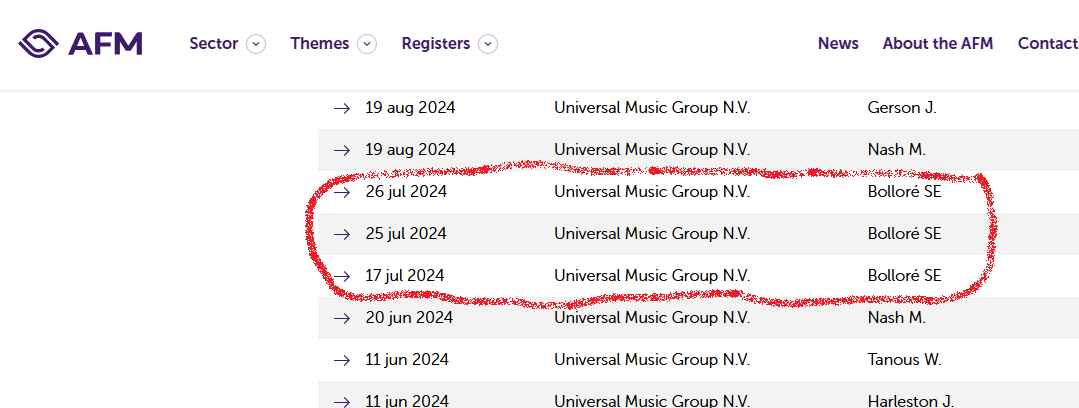

The Bolloré group and Vivendi are major shareholders of Universal Music Group (UMG). We know that Bolloré bought additional UMG shares last year when the share price took a short dive towards 20€. Bolloré SE disclosed this in their financial reports, but it was also disclosed to the AFM (UMG is listed in Amsterdam, like Havas):

How can this be? Well, the PDMR related to the Bolloré Group at UMG is Cyrille Bolloré, the chairman and CEO of Bolloré SE - thus also a PDMR within the “ESMA interpretation” at Bolloré SE since he would be the one (on paper) making the decision to transact in UMG shares.

So in this regards, the theory holds. Is there also a negative example - where we know a trade was made, and it was not disclosed? In my view, yes

Check 2 - NACON

Nacon is a french computer gaming company, a subsidiary of BigBen Entertainment (both are listed on the french market). Bolloré SE holds (via its wholly-owned Luxembourg subsidiary “Nord-Sumatra Investissements”) 21.7% of BigBen and 3.25% of Nacon. BigBen owns a controlling stake (52.3%) in Nacon.

Now, we know that Nacon carried out a capital increase via rights issue last year (summer of 2024), and Bolloré SE subscribed to that capital increase (via Nord-Sumatra)

The PDMR related to Bolloré SE at Nacon is Sébastien Bolloré (the third of the brothers). He is a member of the board of Bolloré SE. Within the meaning of the “ESMA clarification”, Sébastien Bolloré is thus not a PDMR at Bolloré (“mere cross board membership”). So there should not have been an MAR declaration by Bolloré SE after they subscribed to the capital increase.

Did Bolloré SE notify the transaction? No, it did not (you can check the AMF website for Nacon declarations).

Conclusion

what can we conclude from this (if my interpretation is correct, which I think it is, but there is no guarantee - we are talking about an arcane EU regulation after all)?

Bolloré does not have to disclose any transactions (as long as it doesn’t cross notifiable thresholds) in shares of Havas, Canal+ or Louis Hachette Group

Absence of proof does not mean proof of absence: we don’t know if they are buying/selling, but also would not be able to know if they were (since there is, according to my interpretation, no obligation to declare)

The large trading volumes (and the, subjectively, quite low valuation of the entities) could indicate buying activity. The next notifiable thresholds would be 40% at Havas, and 50% at Louis Hachette and Canal+. There is substantial headroom for silent accumulation. Keep in mind that Bolloré has around 6 billion Euros in cash they could be able to deploy.

We will probably have to wait until March, when Bolloré SE will announce its annual results, to see (maybe) if transactions were made and to what extent.

I hope you enjoyed this short trip into the depths of the EU market abuse regulation and its application to the Bolloré/Vivendi practical case.